Investing in a 10 Marla brand new house blends luxury living with high ROI potential. Luxury real estate is no longer just a status symbol—it’s a smart investment with soaring returns. A 10 Marla house, roughly 2,250 square feet or 209 square meters, is a common property size in countries like Pakistan and India. These homes are gaining traction as brand new luxury properties surge in popularity among investors. Why? They boast modern amenities like smart home technology and energy-efficient designs, plus top-tier construction quality. This is fueled by premium features, strategic locations in thriving areas, and strong market demand. It’s a clear win for those seeking both comfort and profit.

Understanding 10 Marla Houses

A 10 Marla house is a popular property size in South Asia, particularly in Pakistan and India. It’s a practical and spacious option for families and investors. This section breaks down what it is and why it matters, using clear headings and subheadings for easy reading.

What is a 10 Marla House?

A 10 Marla brand new house covers about 2,250 square feet or 209 square meters. It’s a standard size in real estate markets where “Marla” is a traditional unit of area. Think of it as a mid-sized home—big enough for comfort, small enough to manage.

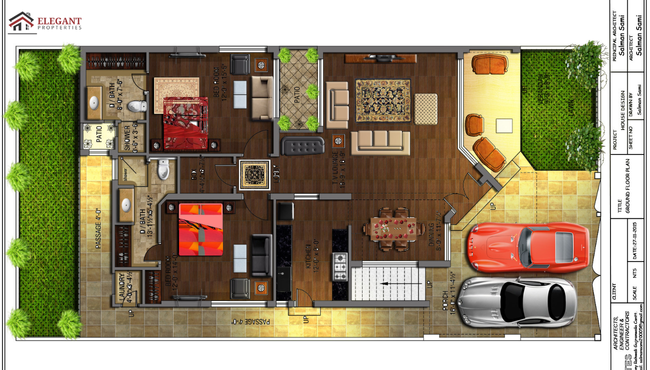

Here’s what you typically get:

- Bedrooms: 4 to 5, perfect for families or guests.

- Living spaces: A formal living room, a family area, and sometimes a dining room.

- Outdoor areas: A garden, terrace, or lawn, depending on the layout.

These homes often feature modern designs with open spaces and good light. They’re built for everyday living, offering both privacy and room to gather.

Why Choose a 10 Marla House?

A 10 Marla brand new house suits people who want space without excess. It’s large enough for a family to spread out but not so big that upkeep feels overwhelming. It’s a sweet spot for practical living.

For investors, it’s a strong choice too. Here’s why:

- Popular demand: Families and professionals love the size, so it’s easy to rent or sell.

- Good rental income: In busy areas, these homes bring in steady returns.

- Solid value: They tend to hold or grow in worth over time.

In simple terms, a 10 Marla house works well for living and for profit. It’s a balanced option that fits many needs.

The Appeal of Brand-New Houses

Advantages Over Resale Homes

Brand new houses shine when compared to resale options. They arrive free of wear and tear, built to modern standards with energy-efficient materials. This means lower utility costs and a lighter environmental load. Plus, warranties often cover appliances and structural parts, offering security resale homes rarely provide.

Customization Opportunities

New homes let buyers take the reins. You can choose high-end finishes, layouts, and designs to match your vision. This personalization isn’t just for enjoyment—it lifts resale value and draws tenants later. A fresh, custom space built for you beats the limits of someone else’s old home.

Luxury Features That Enhance Value

High-End Finishes

Luxury homes stand out with top-tier details. Think marble flooring, granite countertops, designer kitchens, and premium bathroom fixtures. These touches don’t just look good—they signal quality and durability. Buyers and renters notice, and that drives value up fast.

Smart Home Technology

Tech takes luxury to the next level. Automated lighting, climate control, and advanced security systems offer convenience and peace of mind. These features appeal to modern tastes, making the home feel cutting-edge. High-income buyers crave that edge, and it pays off in demand.

Spacious and Functional Layouts

Space sells. Open floor plans, ensuite bedrooms, and outdoor areas like terraces or lawns create a flow that feels both grand and practical. These layouts suit upscale living and catch the eye of wealthy buyers or renters. A home that works as good as it looks holds its worth.

Location: The Key to High ROI

Why Location Matters

Location isn’t just a detail—it’s the backbone of value. A home near schools, hospitals, shopping centers, or transportation hubs wins every time. These spots make life easier, and that pulls in buyers and renters. Good proximity means higher demand, plain and simple.

Identifying Prime Locations

Smart investors hunt for the right spots. Look at areas with upcoming infrastructure—like new roads or transit—or places where prices keep climbing. These signs point to profit. Location fuels long-term appreciation and keeps rental demand strong. Pick well, and the returns follow.

Market Trends Supporting Investment

Current Demand for Luxury Homes

The luxury home market is booming. Demand climbs as affluent buyers seek standout properties. Reports show the luxury real estate market grew by 6.9% in 2023, according to a credible industry source. This surge reflects a hunger for high-end living, fueled by wealth and a taste for exclusivity. Investors see the signal: luxury homes aren’t just houses—they’re assets with staying power.

Trends in 10 Marla House Sales

Sales of 10 Marla brand new house are on the rise. Prices creep up as buyers chase these properties in urban and suburban hubs. New constructions draw the most eyes, offering modern appeal and fresh starts. Data points to steady appreciation—values climb as demand outpaces supply. In cities and their outskirts, these homes hit a sweet spot: big enough for comfort, smart enough for profit. The trend is clear—new builds in prime spots is gold.

Financial Considerations

Investment Costs

A 10 Marla brand new house in Pakistan comes with a clear price tag. In growing urban markets like Lahore or Islamabad, expect to pay PKR 5 crore to PKR 7 crore, depending on the area and finishes. That’s not all. Add taxes—around 1-2% of the value yearly, so PKR 5 lakh to PKR 14 lakh—plus legal fees of PKR 1 lakh to PKR 3 lakh. Maintenance? Budget PKR 2 lakh annually. These figures aren’t random; they reflect today’s market. Know the full cost before you dive in.

Financing Options

You don’t need all cash upfront. Banks offer mortgages at 13-15% interest—manageable monthly payments if you qualify. Developer plans let you stretch costs over years, often with lighter terms. Loans vary by bank, but rates hover around 14%. Pick what suits your pocket. It’s your call, and every option shifts the load differently.

Potential Income Streams

These homes can earn. In prime spots, luxury rentals fetch 5-7% yearly—PKR 25 lakh to PKR 49 lakh on a PKR 7 crore house. Appreciation adds more. Markets show 4-6% growth annually in hot areas—PKR 20 lakh to PKR 42 lakh extra over time. It’s not luck; it’s trends showing demand for new builds. Profit’s there if you play it right.

Calculating ROI

What is ROI?

Return on Investment—ROI—tells you what you earn. It’s simple: take your net profit, divide by the cost, then multiply by 100. Say you spend PKR 5 crore and make PKR 25 lakh after expenses—that’s your profit. Plug it in, and ROI shows your gain as a percentage. It’s the yardstick for profit, clear as day.

Factors Affecting ROI

Not all homes pay the same. Location sets the pace—prime spots beat backroads. Property condition matters; new builds hold strong. Rental demand shifts the numbers—hot areas pull more tenants. Timing’s key too—buy low, sell high. Each piece moves the needle on your return.

Hypothetical Example

Picture this: you buy a house for PKR 5 crore. Annual rent brings PKR 30 lakh. Add 5% appreciation—PKR 25 lakh in value growth. Total gain hits PKR 55 lakh, minus costs. ROI lands around 11%. It’s not a promise—just math showing what’s possible in Pakistan’s market today.

Managing Investment Risks

Common Risks

Investing isn’t foolproof. Markets can crash—prices drop fast. Repairs sneak up, draining your wallet. Vacancies sting too; empty homes earn nothing. These risks hit hard if you’re not ready. Every property carries a gamble, and the stakes are real.

Mitigation Strategies

You can fight back. Spread your money—don’t bet on one house. Get insurance; it softens the blow of damage. Check the place top to bottom before signing—cracks hide easy. Dig into the developer’s name and the papers too. Good homework cuts trouble down. Due diligence isn’t optional; it’s your shield.

Conclusion

Recap

A 10 Marla brand new house pays off. Luxury features—like marble floors and smart tech—draw eyes. Prime locations near schools or hubs lock in value. Financial perks—rental income and steady growth—seal the deal. Together, they push ROI high. It’s a solid play, built on facts.

Call to Action

Don’t sit still. Talk to real estate pros who know the game. Scout listings in your area—see what’s out there. Action beats waiting every time.

Closing Thought

Investing in a 10 Marla brand new house isn’t just luxury. It’s a sharp move for wealth that lasts.

Guide Map to 10 Marla Brand New House

FAQs

Q1: What makes a 10 Marla brand new house a good investment?

A: It’s fresh—no wear, no tear. Luxury features like granite counters and smart tech boost appeal. Prime locations drive value up. You get rentals of PKR 25 lakh to PKR 49 lakh yearly and 4-6% appreciation. New builds beat old homes for profit with 10 Marla brand new house.

Q2: How much does a 10 Marla brand new house cost in Pakistan?

A: In cities like Lahore or Karachi, prices range from PKR 5 crore to PKR 7 crore. Add PKR 5 lakh to PKR 14 lakh yearly for taxes, PKR 1 lakh to PKR 3 lakh for legal fees, and PKR 2 lakh for upkeep. Location sets the final tab for 10 Marla brand new house

Q3: What risks should I watch for?

A: Markets can dip—values drop. Repairs hit unexpectedly. Vacancies leave you dry. Check the property, insure it, and spread your bets. Risks shrink with care.

Q4: How can I finance this investment?

A: Banks offer mortgages at 13-15% interest. Developers give payment plans—years to pay, less hassle. Loans work too, around 14%. Pick what you can carry.

Q5: What’s the ROI potential?

A: Take a PKR 5 crore 10 marla brand new house. Rent it for PKR 30 lakh yearly, add PKR 25 lakh from 5% growth. That’s PKR 55 lakh gain. ROI hits 11%. Location and timing tweak the numbers.

Q6: How do I choose the right location?

A: Look for schools, hospitals, or new roads nearby. Areas with price growth—like DHA Lahore—promise returns. Demand stays high there. Dig into trends before you buy.

Q7: Why go for luxury features?

A: Marble floors and smart systems pull high-income renters. They pay more—5-7% yields prove it. Luxury adds resale value too. It’s not just flash; it’s cash.